Find Out If In-Home Care Tax Is Deductible [2023 Updated]

Providing home care can, no doubt, be an expensive process to go through. Accommodating your loved ones with the best healthcare is essential, however, this may make you wonder if the healthcare they’re receiving is tax deductible.

Spending on health expenses, whether on your own, your spouse, or another dependant can qualify as tax deductible. With the presence of tax deductions, in-home care can be made much more affordable and accessible. This article aims to explore the criteria of tax deductibility and several other questions that may arise when considering in-home care.

Yes, in most cases, in-home care tax is deductible. The Internal Revenue Service of the USA has given out strict guidelines on what healthcare facility is deductible and what is not. Another important factor to consider is the type of care you or your loved one is receiving.

What are the Criteria for Home Health Care to be Tax Deductible?

The criteria for home health care to be tax deductible involves the necessity of medical care provided. To qualify for tax deductions, the home care costs must revolve around the prevention or alleviation of a chronic disease. Moreover, the care provided should be qualified by a healthcare professional.

Medical expenses that can qualify may include nursing services, in-home care, and medical supplies. Keep a detailed record of these expenses, such as receipts and invoices with you.

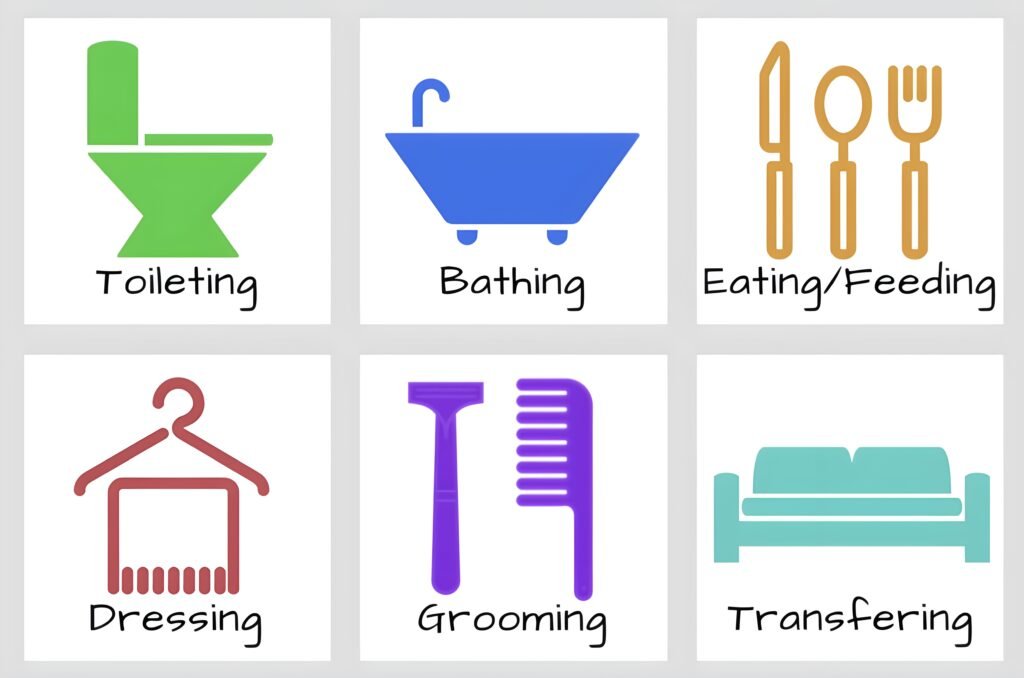

Is Assistance with ADLs in In-Home Care Tax Deductible?

Yes, if an individual is unable to perform at least two ADLs and needs significant assistance with them. According to the IRS, a healthcare professional should document this need for assistance to qualify for tax deductions.

However, there are certain in-home tasks that do not qualify for tax deductions. Although these tasks may be completed with the assistance of caregivers, considering their insignificance, these expenses are considered non-deductible. These non-deductible expenses may include laundry, cooking, cleaning, or companionship.

Related Read: 6 Activities of Daily Living & Need for Long-Term Care [UPDATED]

Can Family Members who Provide Care, Claim Tax Deductions?

With certain conditions met, family members can be eligible to claim tax deductions. Some of the strict guidelines provided by the IRS include the following.

Dependency Status

The person receiving care must qualify as a dependent. This involves several other aspects such as their relationship with the caregiver, financial support provided, and residential needs.

Medical Necessity

The care provided must be necessary for the medical reasons. The expenses must cover the prevention or treatment of the disease. It may include medications or medical equipment provided for treatment of the disease.

Documentation

It is vital to keep a record of documentation including receipts and invoices or any relevant medical documentation. Keeping proof of documents with you can potentially help in claiming the tax deductions from the expenses spent on in-home care.

Financial Support

The caregiver needs to provide a significant portion of financial support to the dependent.

What Home Care Expenses Qualify for Tax Deductions?

Certain home care expenses may qualify for tax deductions. It’s essential to recognize these expenses which can potentially help you deal with finances in providing quality healthcare for yourself or for your loved ones.

Qualified Medical Services

Medical services provided by healthcare professionals such as physicians or medical experts can qualify for tax deductions.

Nursing Care

Payments for in-home nursing care provided by either a registered nurse(RN) or licensed practical nurse(LPN) can be considered qualifiable for tax deduction.

Therapy Services

Costs associated with any important therapy prescribed by a healthcare professional can qualify for tax deductions. These therapies may include occupational therapy, physical therapy, or any other medically relevant therapy.

Medical Supplies

The expenses for important medical supplies, equipment, and devices are considered tax deductible.

Prescription Medication

The cost of prescription medication provided by a healthcare professional qualifies as an in-home healthcare expense that is tax deductible.

Special Diets

The expense related to a diet that is essential for the patient may also be considered qualifiable for tax deduction

What Documentation is Required for In-Home Care Tax Deductions?

When claiming in-home care tax deductions, it is crucial to keep accurate and relevant documentation close. These documents can help claim what’s rightfully yours.

Receipts and Invoices

Keep all the receipts and invoices proving the in-home care expenses safe. This includes payment to caregivers, nursing facilities, or service providers.

Medical Prescriptions

If the in-home care is prescribed by a healthcare professional. Keep the prescription secure, to claim tax deduction as an in-home care expense.

Information of Caregiver

Maintain the record that helps in the identification of the caregiver. The document should include the caregiver’s name, address, and affiliation with their respective care facility.

Medical Record

Maintain relevant medical documents that justify the need for in-home care.

Dependency Documentation

If the person receiving in-home care qualifies as a dependent. The caregiver should keep documents, proving the individual’s dependency, residency, and financial support close to claim later in life.

Difference Between Medical and Non-Medical In-Home Care

Medical and non-medical in-home care have distinct approaches to healthcare. It is essential to know the difference between the two to claim tax deductions from the in-home care provided.

The primary goal of medical in-home care is to treat and manage certain chronic diseases. However, in the case of non-medical in-home care, the primary goal is to provide aid in ADLs and enhance overall quality of life.

The services provided in medical care include several therapies, nursing care, medication, and the use of necessary equipment to treat their conditions. However, in the case of non-medical care, the services provided include meal preparation, transportation, and light housekeeping.

Staffing in medical in-home care is provided by professional nurses and therapists, whereas, in the case of non-medical care, help is usually provided by caregivers termed as personal care aides

Conclusion

Is in-home care tax deductible or not is a commonly asked question that decides whether most individuals seek in-home care for themselves or their loved ones or not. People must know about specific financial assistance the IRS offers to receive the best health care without having to worry about financial issues.

It is also essential to keep the relevant documents safe and secure to claim the tax deductions later in life. While certain aspects may not be considered qualifiable for tax deductions, most in-home care facilities that include medical aspects do qualify.

![Things You Should Know About Respite Care [2024 Guide]](https://caringhandshomecarefl.com/blog/wp-content/uploads/2024/02/What-is-Respire-Care-768x429.jpg)

![6 Activities of Daily Living & Need for Long-Term Care [UPDATED]](https://caringhandshomecarefl.com/blog/wp-content/uploads/2023/11/ADLs-and-IADLs-What-Are-They_-768x512.jpg)